33+ payroll tax calculator louisiana

C2 Select Your Filing Status. Get Your Quote Today with SurePayroll.

2 Cascade Road Emmett Id 83617 Compass

Web Louisiana requires all payments greater than 5000 to be made electronically.

/cloudfront-us-east-1.images.arcpublishing.com/gray/IVB6LL3EXZAH5F2TLBLMBKMYEQ.jpg)

. Louisianas state cigarette tax of 108 per pack of 20 cigarettes. Louisiana Income Tax Calculator 2022-2023. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

C1 Select Tax Year. Web Best Payroll Services Best Payroll Software Best PEO Services. Web Line 1-3 Enter the correct amount of Louisiana income tax withheld or required to be withheld from the wages of your employees for the appropriate month.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. Withhold 62 of each employees taxable wages until they earn gross pay of 160200 in a given calendar year. Ad Payroll So Easy You Can Set It Up Run It Yourself.

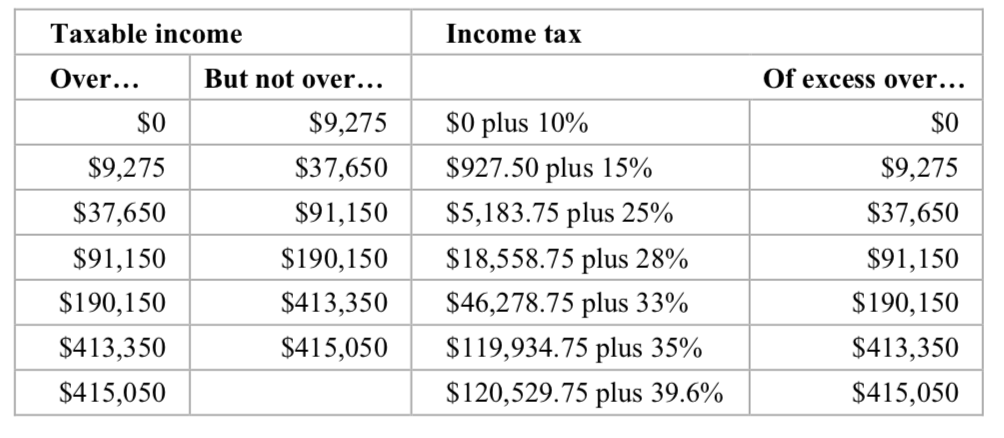

In 2023 the rate. Its income tax system is progressive with rates ranging from 185 to 425so the more. Web The overall structure of the formulas used to compute the withholding tax is to calculate the tax on the total wage amount and then subtract.

Web The Louisiana Tax Calculator. Along with paying the tax employers need to file quarterly payroll tax reports on Form L-1. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

New businesses may need to upgrade to the Electronic Federal Tax. Get 3 Months Free Payroll. In addition to sales taxes alcohol in Louisiana.

Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. Fingerchecks payroll solution offers more in-depth information about such. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Businesses Can Receive Up to 26k Per Eligible Employee. Process Payroll Faster Easier With ADP Payroll. Get Started with up to 6 Months Free.

Ad Calculate Your Payroll With ADP Payroll. Line 4 Add Lines. Web Employers must make all payments greater than 5000 electronically.

Web Louisiana State Unemployment Insurance SUI As an employer in Louisiana you have to pay unemployment insurance to the state. Ad Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Ad Compare This Years Top 5 Free Payroll Software.

Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. Web Louisiana tax year starts from July 01 the year before to June 30 the current year. Estimate Your Federal and Louisiana Taxes.

Web Social Security tax. Ad Get full-service payroll automatic tax calculations and compliance help with Gusto. No more surprise fees from other payroll providers.

Daily Louisiana Income Tax. Web Important note on the salary paycheck calculator. The maximum an employee.

Ad Calculate Your Payroll With ADP Payroll. Verify Your Eligibility Today. Get Started With ADP Payroll.

Web Louisiana Cigarette Tax. Web Calculate your Louisiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. All Services Backed by Tax Guarantee.

Process Payroll Faster Easier With ADP Payroll. Web For each payroll federal income tax is calculated based on the answers provided on the W-4 and year to date income which is then referenced to the tax tables in IRS Publication. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Web Our free payroll tax calculator can help you answer questions about federal and state withholding. Web Louisiana has only one state-specific payroll form and no local taxes. Web Here are the basic steps for paying a salary in Louisiana.

Get 3 Months Free Payroll. Set up your business as an employer. Quarterly payroll tax returns are required using Form L-1 Employers Return for Louisiana Withholding.

Free Unbiased Reviews Top Picks. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Get Started With ADP Payroll.

Web The Louisiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. Get honest pricing with Gusto.

Payroll Tax Definition What Are Payroll Taxes Taxedu Tax Foundation

/cloudfront-us-east-1.images.arcpublishing.com/gray/IVB6LL3EXZAH5F2TLBLMBKMYEQ.jpg)

Portion Of 2020 Unemployment Benefits Exempt From Louisiana State Income Tax

How Much Money Do You Make R Askanamerican

Louisiana Paycheck Calculator Smartasset

Louisiana Hourly Paycheck Calculator Gusto

Louisiana Salary Calculator 2023 Icalculator

Free 10 Sample Invoice For Consulting Services In Pdf

Key Insights For Leasing Industry Professionals By E Greenews Distribution Issuu

Paycheck Calculator Louisiana La Hourly Salary

Louisiana Hourly Paycheck Calculator Gusto

Tax Calculator Estimate Your Income Tax For 2022 Free

How To Reform Payroll Taxes To Fund Medicare For All People S Policy Project

Calculate My Paycheck Louisiana

Us Salary Calculator Salary After Tax

Solved Extra 4 3 Develop The Income Tax Calculator In This Chegg Com

Who Actually Earns 400 000 Per Year

Louisiana Income Tax Calculator Smartasset